You Are Not Alone

The human mind is an incredible machine, but the machine was not designed for the unique environment of the markets, where rapid change, irrationality and excess all prevail. Our external world does not display these Characteristics, but the markets do. Since all market players are human, this leads to the obvious conclusion that Everyone is susceptible to acting incorrectly in the markets. In fact, when placed in the financial markets arena, the most cautious, intelligent, rational, and successful person may bear no resemblance to their personality or performance outside of it. The alien environment in which he is now trying to function distorts his perception and perspective of events.

You have had some wins, some trades that provided good results. You have most likely cursed at yourself and the market for making really stupid move(s) that wiped out most of your account, if not all of a month’s profit, in one foul swoop. It may even have been a trade that you were given by recommendation by others, or even a broker, so you invested far too much and lost it all.

Eventually, you licked your wounds and got back to trading. At this point, you may have recovered from your financial and psychological loss, and some wins started coming back to you. But on the whole, you suspect that you could do much better than you have done so far.

About Me

Since 2010, I began my thorny path in the market, and only in 2016 I began to make solid money in this market. Over the course of six years, moving from manual trading to using various trading bots, I have come to the conclusion that any Forex trading method, including manual trading, bots, martingale strategies and averaging, is completely ineffective. I researched dozens of trading systems, tried hundreds of position management approaches, used every possible analysis method, consulted with a psychologist, studied many books, and studied with one of the famous traders of the time (who will remain anonymous). Sometimes I made money successfully, but most of the time I lost money, even went into debt. My attempts at manual trading systems were unsuccessful and I lost more than 75000USD in a year.

In 2016, feeling completely desperate, I switched to algorithmic Trading as the last strategy that could possibly bring me income in this brutal Forex market. There were no tools or information available at the time, and I was forced to search the darkest corners of the internet for the data I needed. A year later, when one of my colleagues completed the beta version of our software, I began trading the news, which brought significant success. We then brought in developers to create a multi-threaded version of the Expert Advisor, which was a real breakthrough. We opened accounts for all my loved ones and when people started seeing results, they also started joining us. Our project continues to grow and strengthen.

How The System Works

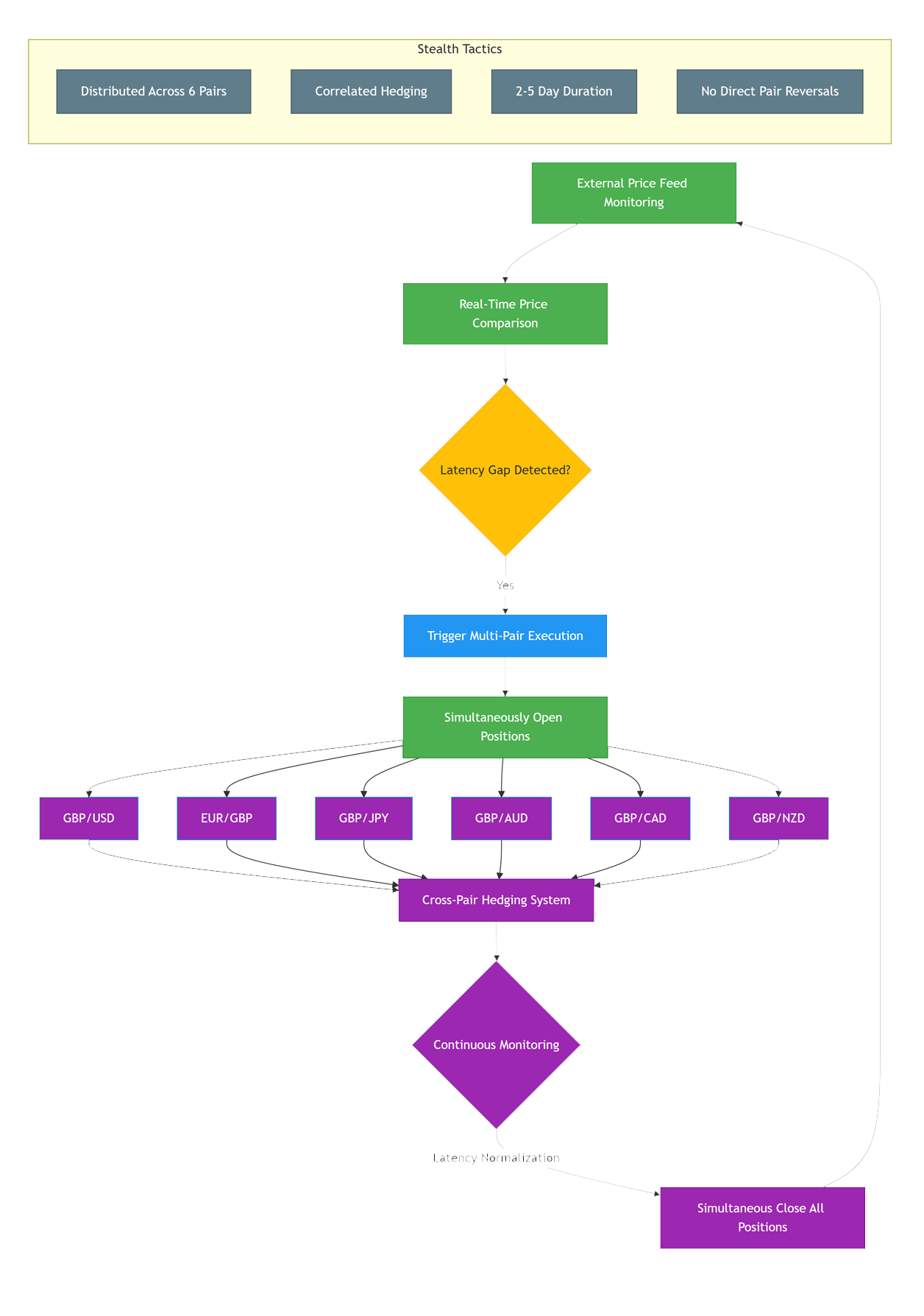

My Expert Advisor (EA) is a semi-arbitrage trading system that leverages liquidity data from external servers, such as LMAX, to detect and exploit minor delays in broker quotes. Unlike traditional arbitrage systems that rely on short-lived price differences within 1–2 seconds, or “Hidden Arbitrage” strategies that use two opposing trades to mask activity, this EA implements a more advanced and discreet arbitrage method.

The system operates across six GBP-related currency pairs, creating a hedge-based structure that makes the arbitrage activity much harder for brokers to detect. This multi-pair approach enables the EA to respond to small latency discrepancies between the broker and external liquidity sources, both when entering and exiting trades. What sets this EA apart is its ability to execute 2-to-6 leg arbitrage simultaneously. These are high-frequency transactions opened across multiple pairs, which provides enhanced stealth and allows the system to remain undetected for 2 to 5 days—long enough to generate consistent profits. This system represents a modern evolution in arbitrage trading, designed not just for profit, but also for resilience and discretion in increasingly regulated and monitored forex environments. Based on my experience, my trading system remains the only reliable method of making money on Forex, which is confirmed by many successful reports with statistics on the independent monitoring of accounts. Reflect on this experience and try not to repeat the mistakes of others. The core of this Expert Advisor (EA) lies in identifying quote delays between your broker and external liquidity providers such as LMAX. These small delays—often just milliseconds—create profitable arbitrage opportunities that the system capitalizes on in a highly strategic and stealthy way.

About my Expert Adviser

QUANTUM SWIFT

- Lorem ipsum dolor sit amet

- Donec sed finibus nisi

- Quisque aliquet velit sit amet

- Morbi tortor nibh fringilla

- Curabitur non bibendum ligula

- In non pulvinar purus curabitur

features

- External Price Feed Monitoring: Continuously monitors faster, more accurate external price feeds (e.g., LMAX) to detect micro-latency differences with broker quotes.

- LMAX Server Cost Included: The EA includes the cost of accessing the LMAX server, ensuring high-quality institutional price data is factored into the strategy.

- Signal Detection and Trade Entry: Detects price discrepancies and enters synchronized trades across six GBP-based pairs, simulating a hedged strategy.

- Trade Hedging Between 6 Pairs: Uses GBP-correlated pairs to hedge across currencies, avoiding mirrored trades and broker detection.

- Tight Stop-Loss on Every Trade: Each trade is protected with a tight stop-loss to limit potential losses and manage risk effectively.

- Trade Exit on Delay: Closes all trades when latency gaps shift or close, maintaining natural trade behavior across pairs.

- Stealth and Duration: Trades span 2 to 5 days, avoiding short-term patterns that trigger broker surveillance.

- Broker Detection and Exit: Designed to exit cleanly even if broker detects the strategy, typically allowing full fund and profit withdrawal.